What is GST (Goods & Services Tax)

Before the GST, indirect Tax made Indian Taxation system so complicated. There are many taxes which was collected by state & central government Goods & services. In this article, we are going discuss. What is GST(Goods & Services Tax) For every Goods and Service, we have to pay separate tax that makes situation worst, there was lot of taxes i.e. Excise duties, Import Duties, Luxury Tax, Central Sales Tax, Service Tax and much more...,

Below you will get a clear picture of the- what is GST(Goods & Services Tax) and benefits of GST. What are the merits, demerits and challenges?

From a long time, GST was the most awaited tax reformation in Indian Taxation history because it enables the "single taxation" system instead of many indirect taxes. This system called GST(Goods and Services Tax). As per its name, it is applicable on both Goods and Services.

History of GST (Goods & Services Tax) in India.

The concept of GST 1st introduced in India during the budget session 2007-08. On 17th December 2014, the proposal was accepted by the current Finance minister. On 19th of December 2014, the bill was presented on GST in Loksabha. In the next session, regular discussions happened and the determination of central government helps to the implementation of GST Constitutional Amendment Bill. GST is the which is applicable on both goods & services. Anyone if is providing or supplying goods and services, then he comes under the GST tax law. Lastly Modi Government was successful in achieving and implementing GST in India , which is going on a scenario.

How is GST will applied in the real time scenario?

Unlike our current taxation, GST is a consumption based tax. It based on the " Destination principle". Where is the consumption happen according to that GST will be applied. GST is applied at every stage of good production to sale. GST paid on the taxes of goods and services and it might be set according to the payable supply of goods or services. Through the tax credit mechanism manufacturer or shopkeeper may claim back paid taxes. As GST is the last point retail tax to most of the time end consumer has to bear the taxes. GST is going to be collected at a point of Sale. As we know GST is an indirect tax, it means that tax was collected through the last stage and customer of the goods and services has to bear the tax. Now the thing is the same situation with indirect taxes then why GST?? Let us understand the above supply chain of GST with an example: Tax credits are not allowed in the current Tax structure. Double taxation policy will be replaced by tax step of the supply chain. This may set to change with the implementation of GST. GST system will be introduced by Indian Government. It has Three components which are known as-CGST contains taxes like Excise duties, service tax, customs duty etc on the other hand SGST contains sales tax, entertainment tax, VAT and other state taxes. Because GST is a comprehensive pack of all indirect taxes that removes the multiple stages of tax calculation and avoid the double tax calculation due to this final cost will reduce.

- Central Goods and Service Tax(CGST)

- State Goods and Service Tax(SGST)

- Integrated Goods and Service(IGST)

So, how is GST collected?

GST will be collected on the place of consumption of Goods and services. It can be collected on :

- -Intra-state supply and consumption of goods & services

- -Inter-state movement of goods

- -Import of Goods & Services

Applied GST rate?

Big doubt in everyone's mind what is GST(Goods & Services Tax). As we know that GST slabs are respective 5%, 12%, 18% & 28%. As per instruction of GST Council. Table: Tax rate after and before GST.

- Complication of Indian taxation will be reduced and taxation becomes simpler as well as easier.

- The entire market will be unified that will provide easy flow of transportation as well as removal of inter state Tax calculation.

- It is also a boost-up for export oriented businesses.

- The lower tax burden will create a good impact on Industry.

- Due to Tax credit supplier can get back incurred GST, that will help them to get better price estimation.

- It can bring more transparency and better compliance.

- Number of tax window will reduce that tends to corruption less economy.

Challenges for implementing Goods & Services Tax system

- -Advanced taxation infrastructure to cop-up with GST.

- -Getting the confidence of every state authority.

- -Estimation of the accurate tax rate that can be effective as well as productive.

In the year 1954, France becomes the first country who introduce GST taxation system. GST will be biggest taxation reform in India. Approx 140 countries are following GST taxation system. Furthermore, there are few which are using VAT as a kind of GST.

Some other items were mentioned in the Council’s announcement of rates. Goods, and its respective tax slab :

- Essential goods like Sugar, Tea, Coffee and Edible oil will fall under the 5 percent slab, while milk will be part of the exempt list under GST. This is to ensure that necessary goods are available at reasonable prices. However, instant food has been kept outside this bracket so, no relaxation for Noodles(Maggi) lovers!!

- Most of the capital goods and industrial intermediate items come under eighteen percent slab. This will be the huge booster for domestic manufacturers and it will also empower the "Make in India" initiative.

- There is a positive sign for power industry of India because coal comes under the 5% slab.

- Good news for daily use product(FMCG), Toothpaste, hair oil, and soaps will all be taxed at 18 percent as GST rates in India.Ultimately Colgate will save your teeth as well as your pocket!

- After knowing GST rates in India sweet may become bitter for because now the delicious “Mithai” comes under the 5% slab.

Summary of Article What is GST(Goods & Services Tax)

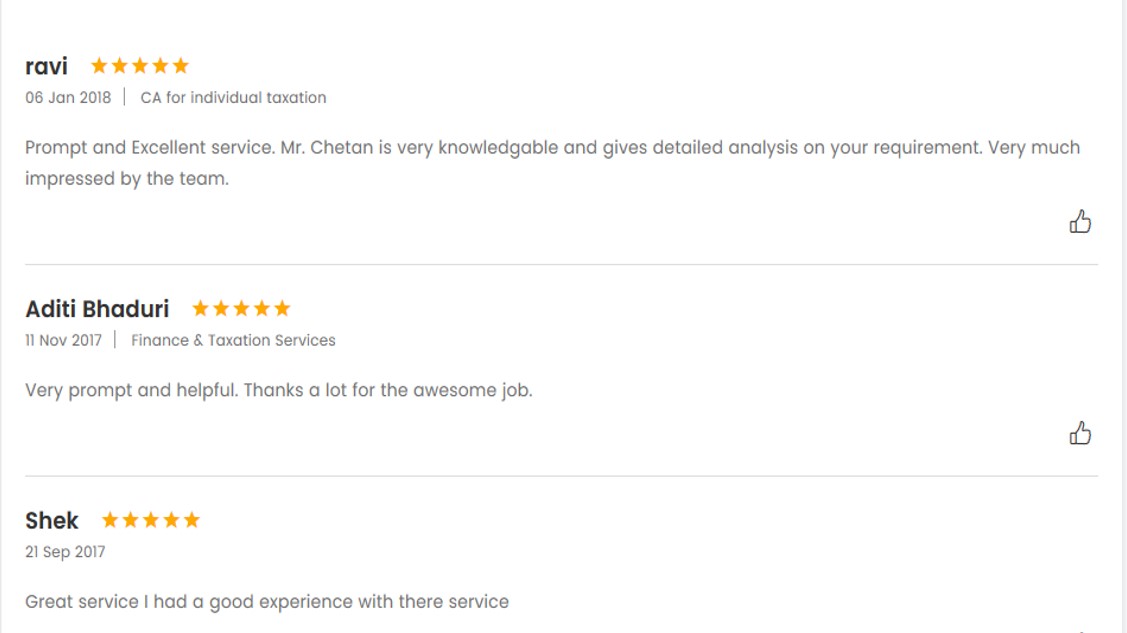

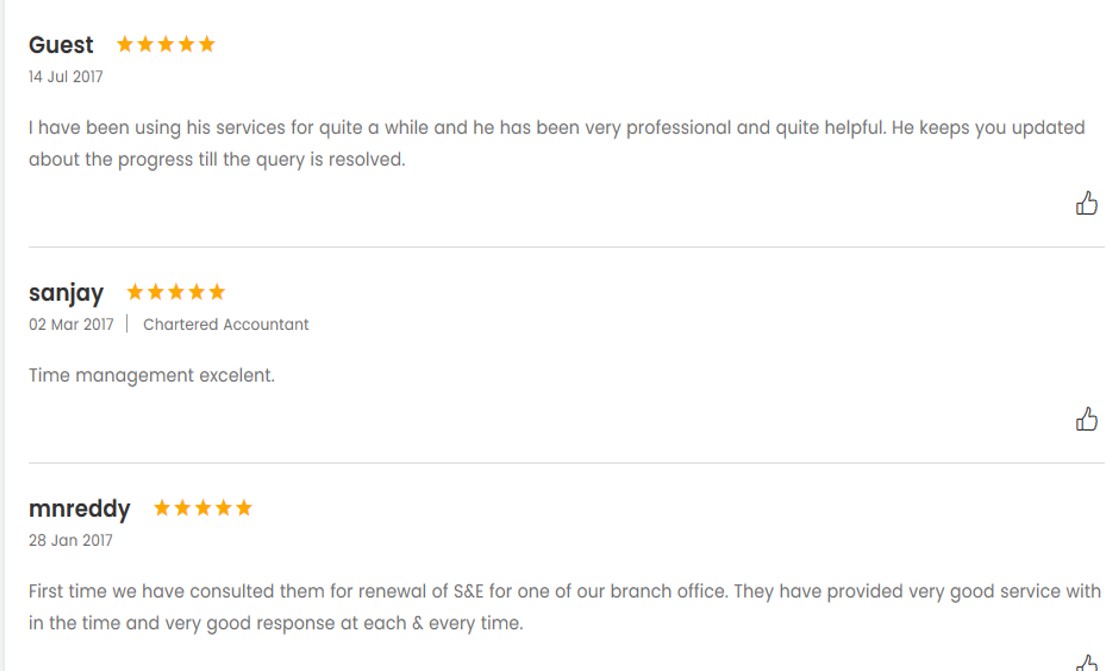

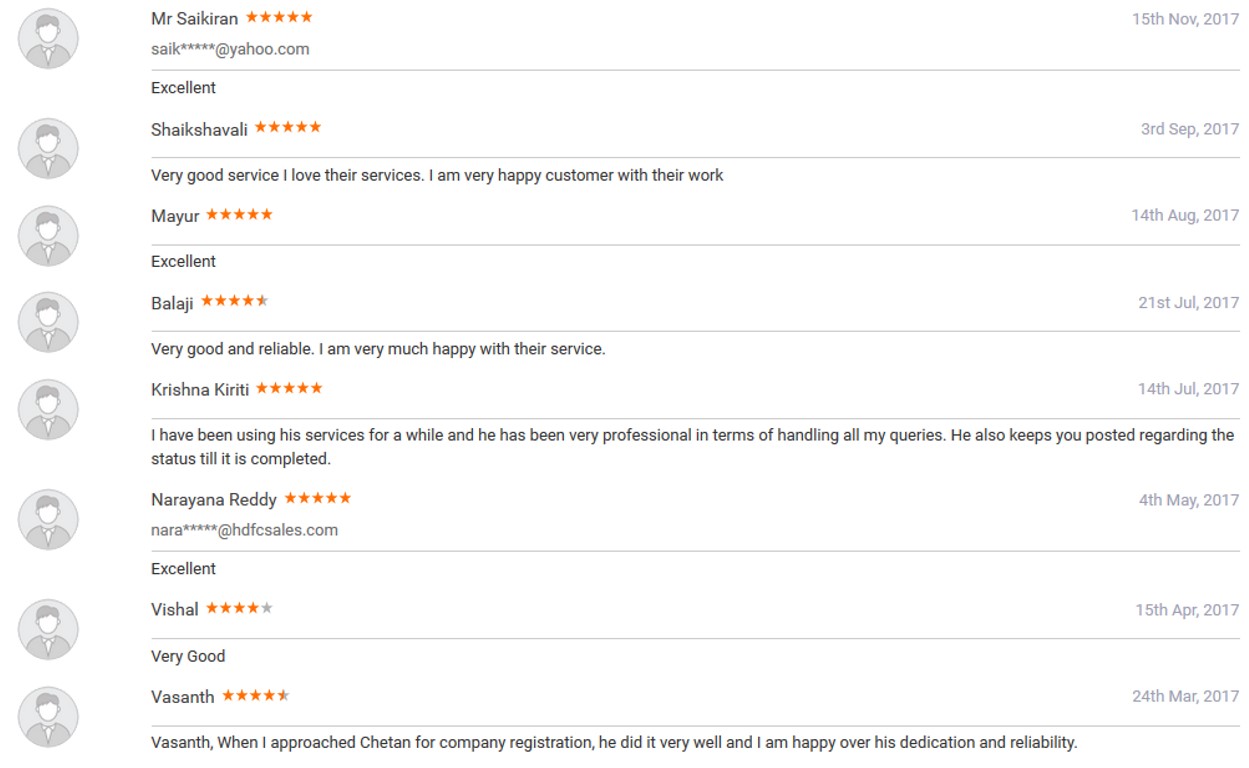

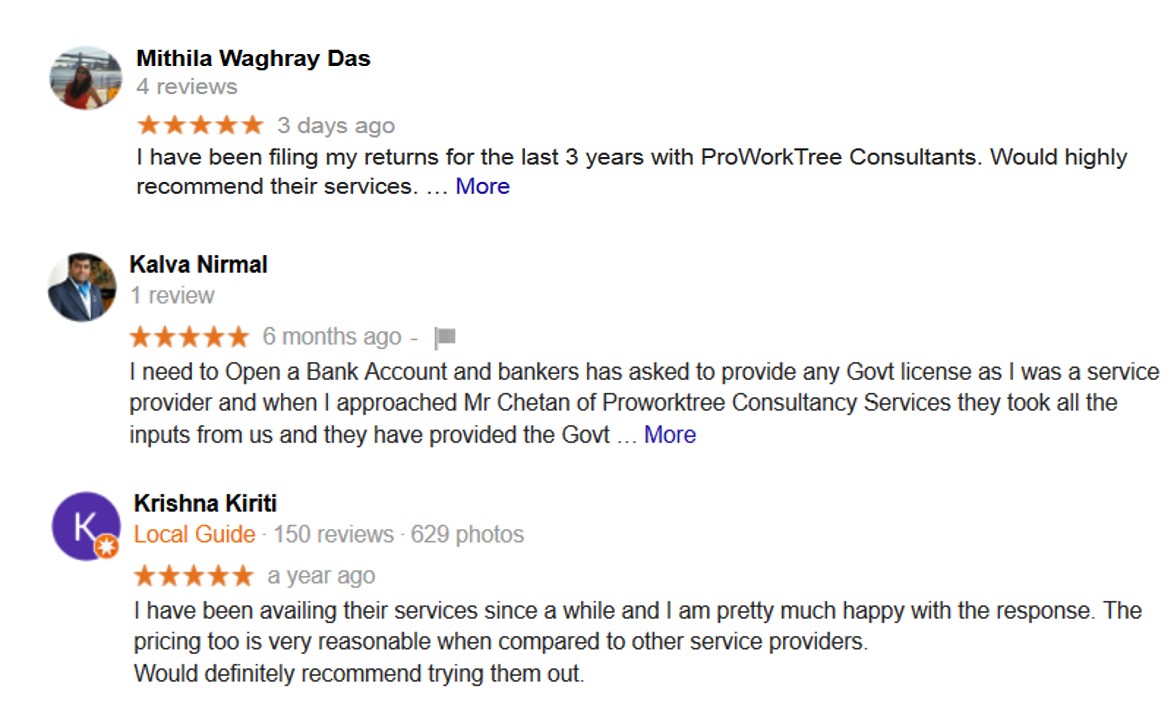

Most probably you got an answer to your question What is GST(Goods & Services Tax), Benefits of GST, Challenges of GST, History of GST. We at proworktree provide you with real time scenario of GST impact that can help you understand clear picture about What is GST(Goods & Services Tax). If you want to have a copy of this article Download it offline or you can also view it on slideshare In case you have any query feel free to contact us. you can also check our services for GST Registration and GST Filling.

Corporate Entity Registration

Corporate Entity Registration

0 comments have been posted.