What is a Goods and Service Tax (GST)?

About Goods and Service Tax

GST means only one indirect tax for the whole nation, which will make India one unified common market. GST registration is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. Therefore the final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. Our aim at Proworktree is to get your Online GST Registration done in Effective, Efficient and Economical way. So do Goods & service tax (GST) Online registration now!!

Who are Required to get Registered Under GST?

GST Registration is PAN and State-specific registration system. Supplier of goods/services should apply for registration from the place where the business is carried out.

The following are the eligibility criteria wherein GST registration can be applied :

- Aggregate Turnover exceeding Rs. 20 Lakhs (Updated limit is Rs. 40 Lakhs) (Rs. 10 Lakhs for the North-Eastern States).

- Registered previously under VAT/Service tax/Excise Laws (Migration of GST)

- Voluntary registration – It is based on Suo moto act of taxpayer to get registered under GST.

- Agents of Supplier

- Supplying goods/services through E-Commerce Operator

- E-commerce Operator who gives goods or services under his brand name (e.g. Amazon, Ola, Uber, Flipkart, etc.,).

- Providing online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person.

- Required to pay Tax deducted at source

- Input Service Distributor

- Making supply to other states (interstate). except up to aggregated turnover of Rs. 20 Lakhs (Updated limit is Rs. 40 Lakhs) (Rs. 10 Lakhs for the North-Eastern States) for services only.

- Having Multiple branches interstate and Intrastate.

- Casual Registration – temporary period registration

- Composition Dealer having

a turnover of up to Rs. 1 Crore (updated limit 1.5 Crore)

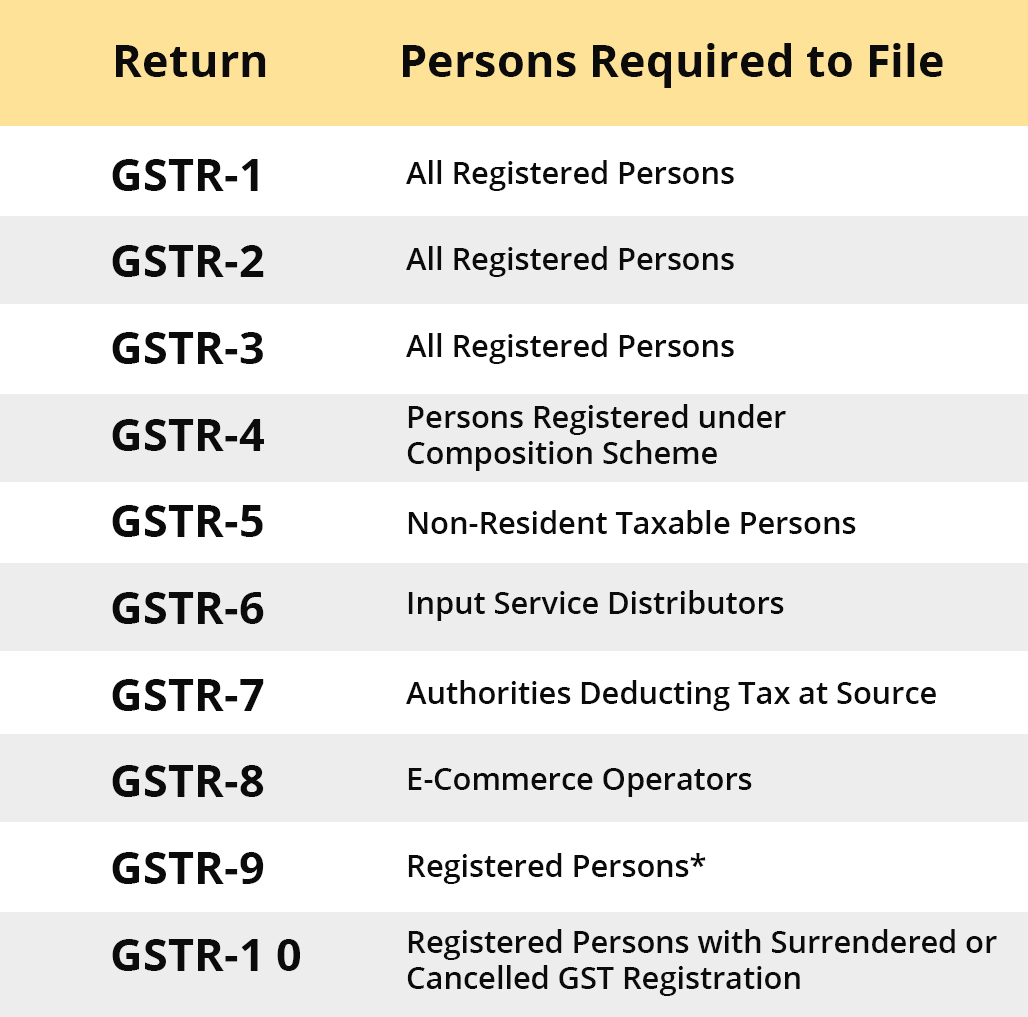

GST Return Filing

After getting GST registration Online, the business will be required to file GST returns at frequent intervals. Failure to file GST returns will attract late fees, Interest, and penalties. Big Business with an annual turnover of more than Rs.1.5 crores (INR 15 Million) are required to file monthly GST returns. The 3 returns to be filed by normal taxpayers are GSTR-1 (details of outward supplies) on the 10th of each month, GSTR-2 (details of inward supplies) on the 15th of each month and GSTR-3 (monthly return) on the 20th of every month. The reduce the compliance burden on small businesses with a turnover of fewer than Rs.1.5 crores, quarterly returns are to be filed commencing from the quarter starting in October 2017 – December 2017. However, GSTR-3B is to be filed monthly by all registered taxpayers (except under Composition scheme) until March 2018 as announced by GST council in its 23rd Council Meeting

Benefits of GST

Easy compliance

Robust and comprehensive IT system is the foundation of the GST regime in India. Which would make compliance easy and transparent.

Removal of cascading effect

Seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business.

Uniformity of GST tax rates and structures

It is ensured that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business.

Improved competitiveness

Reduction in transaction costs of doing business will eventually lead to an improved competitiveness for the trade and industry in the market.

GST Registration Online Process

Applicability of GST : GST is applicable to only those business or persons, whose turnover is more than Rs. 20 lakhs (Updated Limit is Rs. 40 Lakh) (For North Eastern States limit is 10 lakhs, the earlier limit was 5 lakhs).

The importance of GST Registration Online : GST registration is the key to unlock various benefits which come under the GST rules. One of those benefits is you can avail seamless input credit. As GST covers all the taxes, tax calculation will become easier and chances of loop-holes will be less.

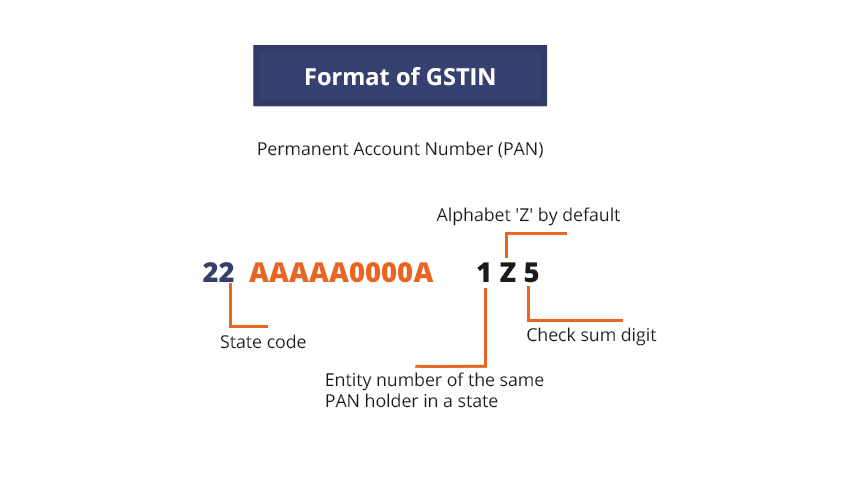

GSTIN : GSTIN means GST Identification Number. According to resource analysis, it is expected that 8-9 million current taxpayers will be the shift from other tax platforms into GST. Moreover, one unique Goods and Services Tax(GST) Identification Number will be assigned to all corporate institutions.

GST Portal : GST portal is the website which is the official site by the government of India to manage GST Registration Online.

Casual Registration : A business whose supplies takes place in GST applicable location but the market is not fixed. Those people are called as a casual taxable person as per GST.

Example: A person whose business location is in Hyderabad supplies taxable consulting services in Chennai where he has no place of business would be treated as a casual taxable person in Chennai.

Composition Dealer : Composition scheme is a big relaxation for small business owners and taxpayers, whose turnover is less than Rs. 1 Crore (Updated Limit is 1.5 Crore). where they have to pay only a nominal rate of 1% or 2.50%.(for manufacturers) Central-GST and State-GST.

Furthermore, they have to do very less documentation work, instead of filling monthly return, they have to file return quarterly once. At the same time, the composition scheme will bring some demerits for small such as:

- They are not able to issue taxable invoices

- It is only for small business

- Won’t applicable on interstate sellers as well as e-commerce business operators.

Migration to GST : All current taxpayer such as Central Excise and Service Tax assessees and VAT(Value Added Tax) dealers will shift to GST. Before shifting to GST, they will get Provisional ID and Password by CBEC/State Commercial Tax Departments.

Only those taxpayer will get Provisional IDs, who have registered with valid PAN. In the following case, an assessee will not get a Provisional ID.

- If the associated PAN is not valid.

- Provisional ID has been supplied by State Tax authority as well as PAN is registered with state tax authority.

- There are several CE/ST registrations on the same PAN in a State. In this case, just one Provisional ID would be issued for the first registration in the alphabetical order provided any of the above two conditions are not met.

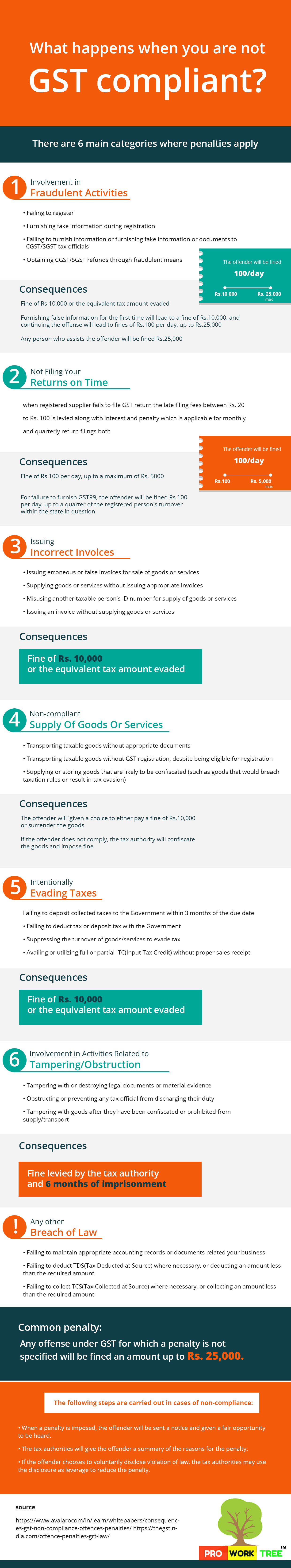

What will be the consequence of not getting GST Registration?

The penalty is 10% of tax amount but the minimum of rupees ten thousand penalty will be charged in case of not paying tax or short payment. The penalty may reach 100% of the tax amount if offenders have been caught in case of serious fraud.

What is included in our GST Registration package

- check_circle GST Application preparation

- check_circle GST Reg Certificate with ARN & GSTIN Number

- check_circle GST Application Filing

- check_circle GST Consultation

- check_circle GST Accounting Consultation

- check_circle GST Invoicing Consultation

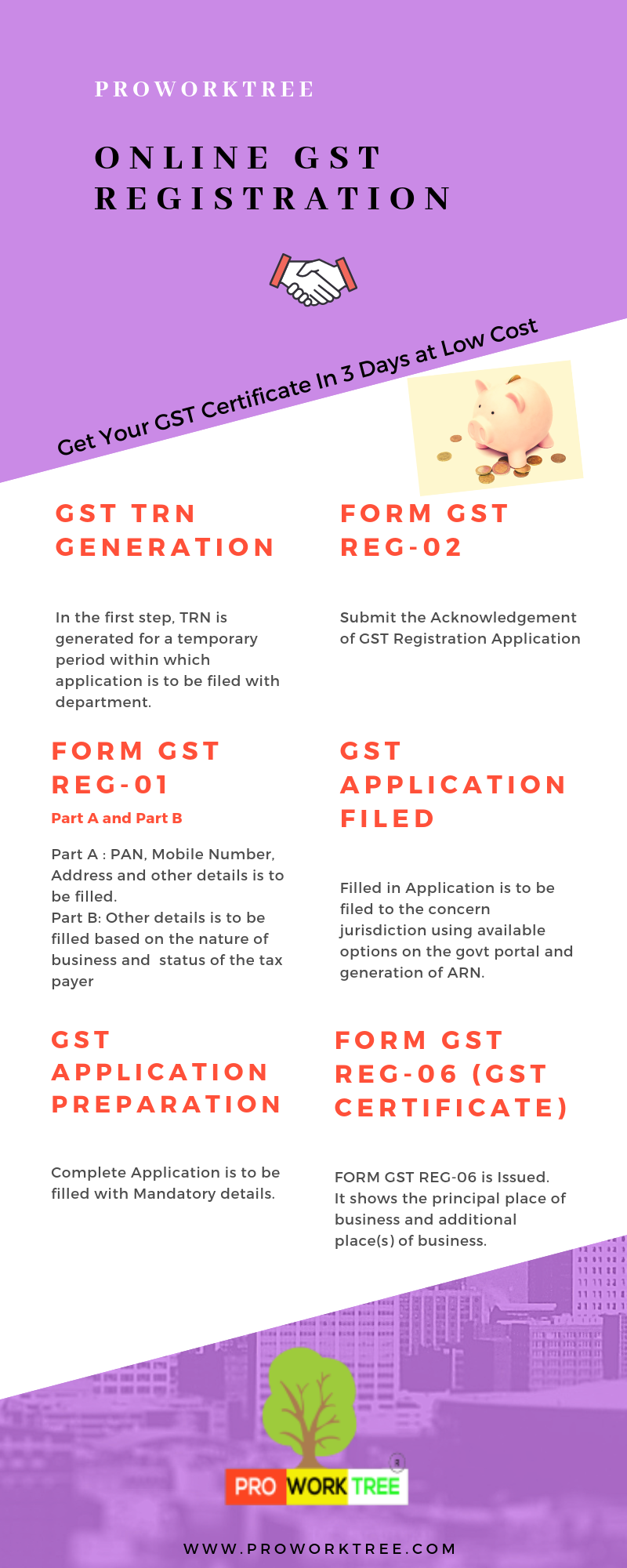

Steps For GST Registration Online

In an few minutes TRN is generated which will be valid for a temporary period within which application is to be filed with department.

FORM GST REG-01

(PART A) Permanent Account Number (PAN), mobile number, e-mail address, State or Union territory in Part A of FORM to be filled.FORM GST REG-01 (PART B) Filling the remaining details and attachments based on the nature of business and Business status of the tax payer

complete application is filled step by step along with other mandatory details to avoid the chances of rejection.

FORM GST REG-02

Submission Acknowledgement of GST Registration Application

After preparing the application, it is filed to the concern jurisdiction using available options on the govt portal and generation of ARN.

FORM GST REG-06 (GST Certificate)

a certificate of registration in FORM GST REG-06 showing the principal place of business and additional place(s) of business shall be issued as registration certificate

Documents Required For GST Registration Online

Documents to be submitted

- Scanned copy of PAN Card of applicant or Passport (Foreign Nationals & NRIs)

- Scanned copy of Aadhar card of the applicant

- Scanned copy of PAN card of Business

- Scanned passport-sized photograph

- Scanned copy of Latest Bank Statement or Cancelled Cheque having the name of the business/applicant or bank passbook (in case of individual only)

- Latest Utility Bill

- In case If the property is owned, scanned copy of Sale Deed or Property Deed in English has to be submitted.

- Mobile number and email ID of applicants

Note : The registered office can be at the residence, too.